Aggregate demand measures the total expenditure in the economy as a whole

It is calculated using the following formula: AD = C + I + G + (X-M)

C = consumption

I = investment

G = government expenditure

X = exports

M = imports

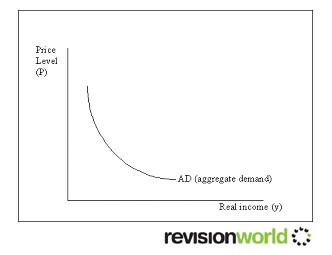

Aggregate Demand Curve

This shows the total level of expenditure at different price levels

The curve slopes from left to right because it is based on the following assumptions :

- Bank of England sets short term interest rates

- A rise in inflation is matched by a rise in interest rates

- An increase in interest rates increases the cost of borrowing

Shifts in the Aggregate Demand Curve

Any change in the components of AD (C,I, G, (X-M) cause the curve to shift

Economic growth is represented by a rightwards shift in the LRAS curve

Aggregate Demand and the Level of Economic Activity

- A change in the level of AD can cause influence the level of national income

- If an economy is operating below its potential level then a shift in AD causes national income to rise in the short term

- The impact of the change in AD depends on how close the economy is to full capacity

Determinants of Aggregate Demand

The determinants of AD are C, I, G, X and M with C representing the consumption expenditure of the economy as a whole

There are a number of factors that influence the level of C including:

- Tax rates

- Inflation

- Wage increases

- Interest rates

- Credit

Wealth : Shares, Property, Savings, Bonds

Determinants of Consumption

- Consumption is affected by interest rates because as interest rates rise the opportunity cost of spending increases and saving becomes more attractive

- In addition as interest rates rise if people have high levels of borrowing their real income will be reduced decreasing rates of consumption

Taxation rates influence consumption as the higher the rate of tax the lower peoples real income and therefore the lower the rate of consumption

Credit influences consumption as if credit is readily available it will increase consumption levels

Wealth influences consumption as if people have wealth in the form of property, stocks etc they are more likely to consume at a higher rate

Determinants of Investment

Investment represents all spending on capital items which are used to generate future incomes. Examples of investment are expenditure on machinery, buildings, equipment and infrastructure

Investment expenditure is influenced by:

- Interest rates

- Sales forecasts

- Inflation projections

- Expected rates of return

When making investment decisions businesses need to ensure that there will be demand to meet the production the investment generates. It is therefore important for them to use sales forecasts when making investment decisions

When making investment decisions firms look at expected rates of return for the action to enable them to decide in the project is worthwhile. There is an inverse relationship between investment and interest rates.

As interest rates fall the cost of investment decreases therefore firms are more likely to invest. Inflation can influence investment as if there is high inflation firms are more likely to make investment decisions as their return is likely to be higher in real terms

Determinants of Government Expenditure

- Government expenditure includes all spending by the public sector in areas such as defence, healthcare, education, social welfare etc

- Government expenditure is heavily influenced by political factors

- Government expenditure is also influenced by the rate of taxation in the country as this is used to fund the spending

Import & Export Expenditure

- If more money is being spent on imports than exports (balance of payments deficit) AD will be reduced

- If more money is being spent on exports than imports (balance of payments surplus) AD will be increased

Economic Growth & Imports

When the economy grows quickly consumption is high and British consumers have a tendency to spend their money on imports. This leads to a larger balance of payments deficit.