Revenue, Costs and Profits

This section explains business revenue, costs and profits. Understanding how revenue, costs, and profits interact is crucial for any business to assess its financial health. Businesses aim to make profits by ensuring their revenue exceeds their costs. This involves calculating the break-even level of output, understanding how to create a break-even graph, and recognising the importance of margin of safety. Businesses also need to be aware of how changes in revenue and costs affect their profits and losses.

Break-even Level of Output

The break-even level of output is the point at which a business’s total revenue equals its total costs. At this level, a business makes neither a profit nor a loss. The break-even point is a critical figure for any business, as it helps to determine the minimum level of sales required to avoid losing money.

Formula for Break-even Point (in units):

Break-Even point (units) = Fixed Costs ÷ (Sales price per unit – Variable costs per unit)

Fixed Costs

Fixed Costs are the costs that do not change regardless of the level of output (e.g., rent, salaries).

Selling Price per Unit is the price at which the product is sold.

Variable Cost per Unit is the cost incurred for producing one unit of the product (e.g., materials, labour).

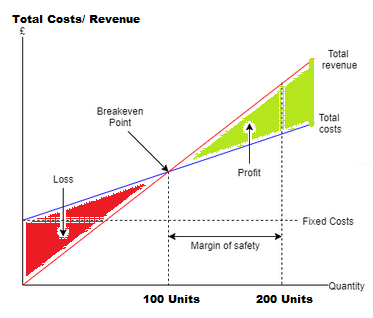

The Break-even Graph

A break-even graph visually represents the relationship between a business’s revenue, costs, and the break-even point. It plots costs and revenue against the level of output (number of units produced and sold).

Creating a Break-even Graph:

Draw two axes:

The horizontal axis (X-axis) represents the level of output (number of units produced).

The vertical axis (Y-axis) represents the amount of money (in £).

Plot the Total Costs Line:

The total costs line starts from the point where fixed costs intersect the Y-axis (because fixed costs are incurred even when no units are produced).

The line then slopes upwards as output increases, reflecting the addition of variable costs as more units are produced.

Plot the Total Revenue Line:

The total revenue line starts from the origin (0 units, 0 revenue) and slopes upwards as sales increase.

The line is drawn based on the selling price per unit multiplied by the level of output.

Mark the Break-even Point:

The break-even point is where the total revenue line intersects with the total costs line. At this point, the business is covering all its costs but making no profit.

Break-even Graph Example:.

Margin of Safety

The margin of safety is the difference between the break-even level of output and the actual level of output. It represents the cushion or safety zone a business has before it starts making a loss. A larger margin of safety means the business is more secure, as it can afford a drop in sales before it begins to lose money.

Formula for Margin of Safety:

Margin of Safety = Actual Output – Break-even Output

Changes in Revenue and Costs

Both revenue and costs can change over time due to various factors, such as changes in demand, production efficiency, and external factors like inflation or supply chain issues. Understanding how these changes affect profits is crucial for business decision-making.

Changes in Revenue

Increase in Revenue: If a business increases its sales volume or the selling price per unit, its total revenue will increase. This can help to cover fixed costs faster and lead to higher profits. For example, increasing the price of a product can increase revenue without needing to increase the number of units sold.

Example:

If the price per unit is raised from £50 to £60, total revenue increases for the same number of units sold.

Decrease in Revenue: If sales decrease or if the selling price is reduced, revenue will fall, which could push the business into loss-making territory unless costs are reduced accordingly.

Example:

If the price per unit drops from £50 to £40, revenue will decrease even if sales volume remains the same.

Changes in Costs

Increase in Fixed Costs: If a business faces an increase in fixed costs (e.g., rent, salaries), the break-even point will rise, meaning the business will need to sell more units to cover these additional costs.

Example:

If fixed costs rise from £5,000 to £6,000, the break-even output will increase because the business has higher costs to cover.

Increase in Variable Costs: If the cost of materials or labour increases, the variable cost per unit will rise. This will also increase the break-even point, as more revenue will be needed to cover the higher cost of production.

Example:

If the variable cost per unit rises from £30 to £35, the business will need to sell more units to break even.

Decrease in Costs: If costs (either fixed or variable) decrease, the break-even point will decrease, meaning the business can cover its costs with fewer sales.

Example:

If the variable cost per unit drops from £30 to £25, the break-even output will be lower, and the business will start making a profit sooner.

Profit and Loss

The profit and loss (P&L) account, or income statement, is used by businesses to track their financial performance. It shows the difference between revenue and costs over a specific period, indicating whether the business is making a profit or a loss.

Profit occurs when revenue exceeds costs.

Profit = Revenue − Total Costs

Example: If revenue is £15,000 and total costs are £12,000, the profit is £3,000.

Loss occurs when costs exceed revenue.

Loss = Total Costs − Revenue

Example: If revenue is £10,000 and total costs are £12,000, the loss is £2,000.

Profitability Ratios:

Businesses often use profitability ratios, like gross profit margin and net profit margin, to evaluate how efficiently they are turning revenue into profit.

Gross Profit Margin = Gross Profit ÷ Revenue x 100

Net Profit Margin = Net Profit ÷ Revenue x 100

Conclusion

Understanding break-even analysis is essential for businesses to assess when they will start making a profit. The break-even level of output, along with the break-even graph, helps businesses visualise their revenue and cost structures. Additionally, the margin of safety provides a buffer against fluctuations in sales. Changes in revenue and costs can have a significant impact on a business's financial performance, influencing its profitability. The ability to monitor and respond to these factors is vital for maintaining financial health and making informed business decisions.