Costs

Costs of Production

Businesses calculate the cost of production

- For forecasting and budgeting

- To set prices so they make a profit

- To work out if they can make a profit

Costs

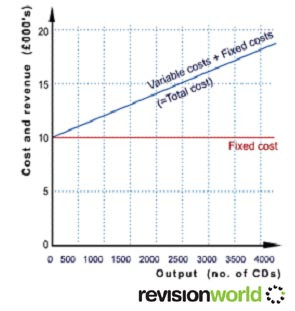

Fixed costs

- These do not alter with output

- Examples – rent, management salaries, rates

- Graphically fixed costs will always be illustrated by a horizontal line

- As output changes fixed costs stay the same

Variable costs

- Alter directly with the business’s level of output

- Examples – fuel, raw materials

- Graphically variable costs will always be a diagonal line from the origin

- As output changes variable alter directly

Total costs

- These are fixed and variable costs added together

Semi variable

- These have a fixed and a variable element

Direct Costs

- Attributed to the production of a particular product and vary directly with output e.g direct materials and labour

Indirect Costs

- Can't be allocated to the production of a specific product and relate to the business as a whole e.g. indirect labour costs, administration

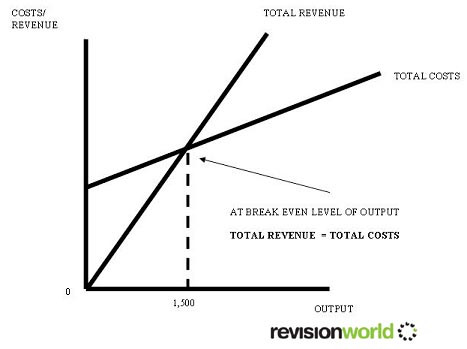

Break-even Analysis

A business breaks even if it does not make a profit or a loss. It is the point at which the business makes just enough revenue to cover their costs. In other words profit = zero.

Businesses must make a profit to survive. To make a profit, revenue must be higher than costs.

Break even analysis can use a number of methods:

- Contribution method

- Break even chart

- Break even graph

Calculating the break-even point (contribution method)

Breakeven Point = Fixed Costs / (Selling Price - Fixed Costs per Unit)

This involves a two part calculation:

Selling Price per unit – variable cost per unit = contribution (towards fixed costs).

AND

Fixed costs divided by contribution = Break even point.