Government Intervention in Markets

This section explains Government Intervention in Markets, covering the Purpose of Government Intervention, Indirect Taxation, Types of Indirect Taxes, Purpose of Taxation, Subsidies, Impact of Subsidies, Purpose of Subsidies, Maximum and Minimum Prices, Other Methods of Government Intervention and State Provision of Public Goods.

Purpose of Government Intervention

Government intervention in markets typically arises when markets fail to allocate resources efficiently, resulting in outcomes that are deemed socially undesirable. Market failure occurs when the free market leads to a misallocation of resources, such as inefficiency, inequality, or harm to the environment. The government steps in to correct these failures through various policy tools, with the primary goal of improving overall social welfare.

Key Objectives of Government Intervention:

- Correct Market Failures: Address situations like externalities (e.g. pollution), monopolies, and public goods.

- Redistribute Income and Wealth: Reducing inequality, providing support for disadvantaged groups.

- Promote Economic Stability and Growth: Mitigate issues like inflation, recession, or high unemployment.

- Encourage Equity and Fairness: Ensure that the benefits of economic activity are widely distributed.

Indirect Taxation (Ad Valorem and Specific Taxes)

One of the primary methods of government intervention is through indirect taxation. Taxes are used to correct market failures, particularly when there are negative externalities (e.g. pollution or harmful consumption like smoking).

Types of Indirect Taxes:

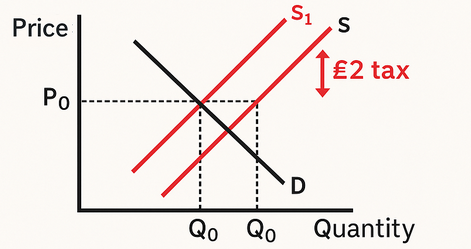

Specific Taxes: These are fixed amounts levied per unit of a good or service. For example, a government might impose a £2 tax on each pack of cigarettes. The effect is to increase the cost of production and shift the supply curve vertically upwards by the amount of the tax.

- Before tax: Equilibrium price and quantity at P₀ and Q₀.

- After tax: Supply curve shifts up (S → S₁). The price rises for consumers and the quantity falls. The consumer bears some of the tax burden, but producers may also absorb part of it.

Ad Valorem Taxes: These are taxes that are a percentage of the price of the good, such as VAT (Value Added Tax). The tax increases with the price of the good, so higher-priced goods face a higher tax burden.

- Before tax: Equilibrium at P₀ and Q₀.

- After tax: The supply curve shifts upwards, but the degree of shift depends on the price level, leading to higher prices for consumers and reduced quantity supplied.

Purpose of Taxation:

- Reduce Negative Externalities: By increasing the price of harmful goods, governments aim to reduce consumption and production.

- Internalise External Costs: Taxes force producers and consumers to account for the social costs of their actions.

Subsidies

Subsidies are payments made by the government to producers or consumers in order to reduce the price of certain goods and services. This is often used to encourage the production or consumption of goods that provide positive externalities or to support industries considered essential (e.g. renewable energy).

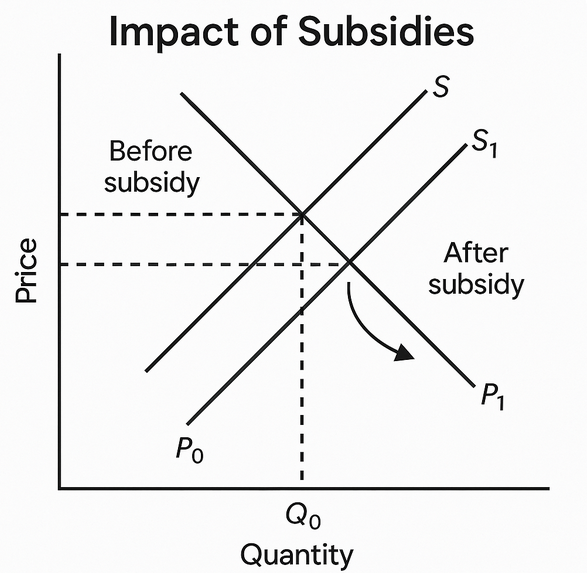

Impact of Subsidies:

- Increase Supply: A subsidy shifts the supply curve downwards (S → S₁), reducing the cost of production, encouraging producers to increase output, and lowering the price for consumers.

- Before subsidy: Equilibrium at P₀ and Q₀.

- After subsidy: The supply curve shifts down (S → S₁), leading to a lower price for consumers and higher quantity exchanged in the market.

Purpose of Subsidies:

- Encourage Positive Externalities: Subsidies are often given to goods like education, healthcare, or renewable energy, which have benefits beyond the individual consumer.

- Support Domestic Industries: Governments may subsidise sectors like agriculture to ensure food security or protect jobs in key industries.

Maximum and Minimum Prices

The government can also set price controls to regulate market prices, which can be either a maximum price (price ceiling) or a minimum price (price floor).

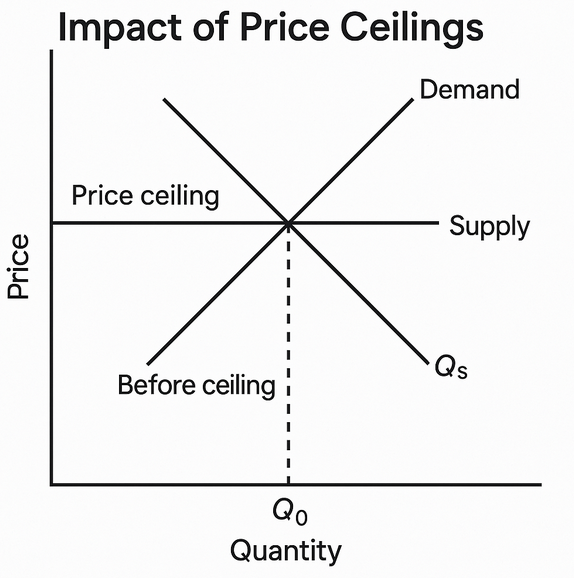

Maximum Price (Price Ceiling):

A price ceiling is a legal limit on how high the price of a good or service can be. The goal is to make essential goods more affordable, especially in times of crisis.

- Example: Rent controls or price ceilings on food during a famine.

Impact:

- Creates a shortage: The demand for the good exceeds the supply at the maximum price. This can lead to inefficiencies, such as black markets or reduced quality of goods.

- Before ceiling: Equilibrium at P₀ and Q₀.

- After ceiling: Price is set below the equilibrium (P₁), leading to higher demand and a shortage (Qd > Qs).

Minimum Price (Price Floor):

A price floor sets a minimum price above the equilibrium price. This is typically used to ensure that producers receive a fair income.

- Example: Minimum wage laws or agricultural price floors.

Impact:

- Creates a surplus: If the price is too high, supply exceeds demand, and there is excess supply in the market, such as unsold goods or unemployment.

Other Methods of Government Intervention

In addition to the traditional tools of taxation, subsidies, and price controls, the government can employ other methods of intervention to correct market failures.

Trade Pollution Permits

Governments can create a market for pollution by issuing tradable pollution permits. These are permits that allow firms to emit a certain amount of pollution. Firms can trade these permits, so those who can reduce emissions most cheaply can sell their excess permits to others.

- Purpose: To reduce the total amount of pollution in a cost-effective manner, providing an economic incentive for firms to reduce emissions.

State Provision of Public Goods

Public goods are goods that are non-excludable and non-rivalrous, meaning that one person’s use of the good doesn’t reduce its availability for others, and no one can be excluded from using it (e.g. national defence, street lighting).

- Purpose: The government provides these goods because private markets would underprovide them due to the free-rider problem.

Provision of Information

Governments often provide information to correct information asymmetries in markets. For example, nutritional information on food packaging or financial advice on mortgages.

- Purpose: To empower consumers to make informed decisions, thereby improving market efficiency and welfare.

Regulation

Governments can impose laws and regulations to control or influence the behaviour of firms and individuals in the marketplace. This can include setting health and safety standards, environmental regulations, and anti-competitive practices laws.

- Purpose: To correct market failures like monopolies, excessive pollution, and unfair business practices.

Summary of Key Government Intervention Tools:

| Intervention Type | Purpose | Diagram or Example |

|---|---|---|

| Indirect Taxes | Internalise externalities (e.g. pollution) | Tax shifts supply curve up, raising prices |

| Subsidies | Encourage positive externalities (e.g. renewable energy) | Subsidy shifts supply curve down, lowering prices |

| Maximum Prices | Protect consumers from excessively high prices | Price ceiling creates a shortage |

| Minimum Prices | Protect producers or workers (e.g. minimum wage) | Price floor creates a surplus |

| Trade Pollution Permits | Reduce pollution efficiently | Market for pollution creates incentives for firms |

| State Provision of Public Goods | Provide non-rivalrous and non-excludable goods | Public goods like defence or street lighting |

| Provision of Information | Correct information asymmetry | Labelling on food or financial disclosures |

| Regulation | Control harmful behaviour (e.g. monopolies) | Laws on environmental or safety standards |

By applying these tools, the government aims to correct market inefficiencies, enhance social welfare, and promote fairness and sustainability within the economy.