Indirect Taxes and Subsidies

This section explains Indirect Taxes and Subsidies covering, Supply and Demand Analysis, Elasticities, and the Impact of Indirect Taxes, the Impact of Indirect Taxes on Consumers, Producers, and Government, Incidence of Indirect Taxes on Consumers and Producers, Impact of Subsidies on Consumers, Producers, and Government and The Area Representing the Producer Subsidy and Consumer Subsidy.

Introduction to Indirect Taxes and Subsidies

Indirect taxes and subsidies are key policy tools used by governments to influence market outcomes. An indirect tax is a tax on goods and services, typically added to the price of a product. A subsidy is a payment made by the government to producers or consumers to encourage the production or consumption of a good or service.

Supply and Demand Analysis, Elasticities, and the Impact of Indirect Taxes

Impact of Indirect Taxes on Consumers, Producers, and Government

An indirect tax (e.g., VAT) increases the cost of production or consumption, which affects the supply and demand in the market.

- Impact on Consumers:

When an indirect tax is imposed, the price of the good typically increases. Consumers now face a higher price, which may lead to a reduction in quantity demanded. The degree to which the price rises depends on the price elasticity of demand (PED). If demand is inelastic, the price increase will be relatively large; if demand is elastic, the price increase will be smaller as consumers reduce their quantity demanded. - Impact on Producers:

The imposition of an indirect tax increases the cost of production for producers. This shifts the supply curve upwards (or to the left). The degree to which producers can pass on the tax to consumers depends on the price elasticity of supply (PES). If supply is inelastic, producers will bear more of the tax burden. If supply is elastic, producers can pass on more of the tax to consumers. - Impact on Government:

The government collects revenue from the indirect tax. This revenue can be used to fund public goods or services, although the efficiency and fairness of such taxes can be debated. The amount of revenue depends on the size of the tax and the quantity of the good sold after the tax is imposed.

Incidence of Indirect Taxes on Consumers and Producers

The tax incidence refers to how the burden of the tax is shared between consumers and producers. This depends on the elasticity of demand and supply.

- Consumer Tax Burden (Incidence on Consumers):

The more inelastic the demand curve, the greater the burden of the tax will fall on consumers. If consumers cannot easily reduce their quantity demanded, they are willing to pay the higher price, and thus they bear more of the tax burden. - Producer Tax Burden (Incidence on Producers):

If supply is inelastic (producers cannot easily change the quantity they supply), the tax burden will fall more heavily on producers. If supply is elastic (producers can adjust the quantity they supply), producers can shift more of the tax burden onto consumers.

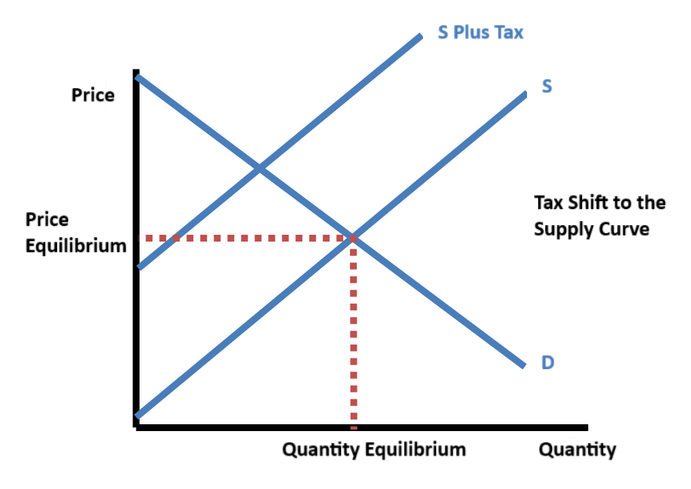

- In a standard supply and demand diagram, the tax shifts the supply curve upwards by the amount of the tax.

- The new equilibrium price is higher, and the equilibrium quantity is lower.

- The vertical distance between the new supply curve and the original supply curve represents the amount of the tax.

- The price consumers pay is higher, and the price producers receive is lower than before the tax was imposed. The difference between these prices shows the division of the tax burden between consumers and producers.

Impact of Subsidies on Consumers, Producers, and Government

A subsidy is a financial assistance provided by the government to encourage the production or consumption of certain goods or services, typically to lower the price for consumers or increase the price received by producers.

Impact on Consumers:

Subsidies typically lower the price of a good or service for consumers, increasing their purchasing power. This leads to an increase in quantity demanded, especially if the demand is price-sensitive (elastic). Consumers benefit from paying a lower price for a good or service than they would without the subsidy.

Impact on Producers:

Subsidies increase the amount of money producers receive for a good or service. This shifts the supply curve downwards (or to the right), as producers are willing to supply more at every price level due to the financial support. The subsidy can encourage producers to increase output, leading to higher quantities of the subsidised good or service being produced and sold.

Impact on Government:

The government bears the cost of subsidies. This represents a financial outlay that the government must fund, typically through taxation or borrowing. Although subsidies benefit consumers and producers, they can be expensive for the government. The effectiveness of subsidies depends on the specific market conditions and the policy goals of the government.

The Area Representing the Producer Subsidy and Consumer Subsidy

In a supply and demand diagram, a subsidy results in a shift of the supply curve downwards by the amount of the subsidy, as producers receive more money per unit sold. The government provides a subsidy to producers for every unit they produce, which reduces their costs and encourages greater supply.

Consumer Subsidy:

- The consumer subsidy is represented by the difference between the price consumers were willing to pay before the subsidy and the lower price they pay after the subsidy.

- This is the area between the new price consumers pay and the original price, extending to the new equilibrium quantity.

- If the demand is elastic, consumers benefit more from the subsidy, as they will buy more at the lower price.

Producer Subsidy:

- The producer subsidy is the difference between the price producers receive after the subsidy and the price they would have received without the subsidy.

- This is represented by the area between the price producers receive (after the subsidy) and the original price they received, up to the new equilibrium quantity.

- If the supply is elastic, producers will be able to respond to the subsidy by increasing output significantly, as they benefit from the higher price they receive.

Summary

- Indirect Taxes:

Indirect taxes increase the price of goods and services, shifting the supply curve leftwards. The incidence of the tax (who bears the burden) depends on the elasticities of demand and supply. Governments collect revenue from indirect taxes, but the impact on consumers and producers varies depending on market conditions. - Subsidies:

Subsidies lower the price consumers pay and increase the price producers receive, shifting the supply curve downwards. Consumers benefit from lower prices, while producers benefit from higher prices. However, subsidies represent a cost to the government, which must fund them through taxation or borrowing. - Tax Incidence:

The incidence of indirect taxes and subsidies depends on the price elasticities of demand and supply. If demand is inelastic, consumers will bear a larger share of the tax burden. If supply is inelastic, producers will bear a larger share. The reverse is true for subsidies.