Characteristics of Aggregate Demand

This section explains The Characteristics of Aggregate Demand (AD) covering, Introduction to Aggregate Demand (AD), Components of Aggregate Demand (C + I + G + (X - M)), The Relative Importance of the Components of AD, The Aggregate Demand (AD) Curve and The Distinction Between a Movement Along, and a Shift of, the AD Curve.

Introduction to Aggregate Demand (AD)

Aggregate Demand (AD) represents the total demand for goods and services within an economy at a given overall price level and in a given period of time. It is a crucial concept in macroeconomics, as it is one of the primary drivers of economic growth and inflation. AD is calculated as the sum of the demand for consumption, investment, government spending, and net exports.

Understanding the components of AD, the relationship between them, and how shifts in AD occur is fundamental for analysing the performance of an economy.

Components of Aggregate Demand (C + I + G + (X - M))

Aggregate demand is made up of four main components, which together form the total demand for goods and services in an economy:

Consumption (C)

Consumption refers to the total spending by households on goods and services. This is typically the largest component of AD in most economies. Consumption includes spending on durable goods (e.g., cars, appliances), non-durable goods (e.g., food, clothing), and services (e.g., healthcare, entertainment).

Key factors affecting consumption include:

- Income: Higher income generally leads to more consumption, as households have more disposable income.

- Interest Rates: Lower interest rates make borrowing cheaper and saving less attractive, encouraging higher consumption.

- Consumer Confidence: If people feel optimistic about the future, they are more likely to spend.

- Wealth Effects: If households feel wealthier (e.g., due to an increase in house prices), they are likely to spend more.

Investment (I)

Investment represents the total spending by businesses on capital goods, such as machinery, equipment, and buildings. It also includes spending on housing construction. Investment is critical for increasing the productive capacity of the economy and fostering future growth.

Key factors affecting investment include:

- Interest Rates: Lower interest rates reduce the cost of borrowing, which can encourage firms to invest more.

- Business Confidence: If firms are optimistic about future demand, they are more likely to invest in expanding their capacity.

- Government Policies: Tax incentives or subsidies for investment can increase investment levels.

Government Spending (G)

Government spending refers to the expenditure by the government on goods and services, including healthcare, education, defence, and infrastructure. Unlike other components of AD, government spending is directly controlled by the government and is often used as a tool of fiscal policy to influence the economy.

Key factors affecting government spending include:

- Fiscal Policy: Governments can increase spending during economic downturns to stimulate demand (expansionary fiscal policy) or reduce spending to cool down an overheating economy (contractionary fiscal policy).

- Political Decisions: The priorities of the ruling government can affect the level and allocation of spending.

Net Exports (X - M)

Net exports are the difference between a country’s exports (X) and imports (M). A positive balance (exports > imports) results in a trade surplus, while a negative balance (imports > exports) leads to a trade deficit. The net exports component reflects the demand for a country's goods and services from abroad.

Key factors affecting net exports include:

- Exchange Rates: A weaker currency makes exports cheaper and imports more expensive, potentially boosting net exports.

- Global Economic Conditions: Strong economic growth in other countries can increase demand for a country’s exports.

- Domestic Income: Higher domestic income can lead to increased imports, reducing net exports.

- Protectionism: Trade barriers, such as tariffs or quotas, can reduce imports and potentially boost net exports.

The Relative Importance of the Components of AD

The relative importance of the components of aggregate demand can vary depending on the structure of the economy and the current economic conditions. In the UK, the largest component of AD is usually consumption (C), followed by government spending (G), investment (I), and net exports (X - M).

- Consumption (C) typically accounts for the majority of AD in many developed economies, including the UK. This is because households make up a large portion of total economic activity.

- Investment (I) is also significant, particularly in a growing economy. Investment contributes to future economic capacity and productivity.

- Government spending (G) plays an important role, particularly during recessions, when the government may increase spending to stimulate demand.

- Net exports (X - M) can be more volatile, as they depend on both domestic and international factors. In the UK, trade deficits have generally meant that net exports contribute less to AD than consumption or investment.

The balance between these components can shift over time. For instance, during periods of economic expansion, investment and net exports may become more important, while in recessions, consumption and government spending may play a more prominent role in supporting AD.

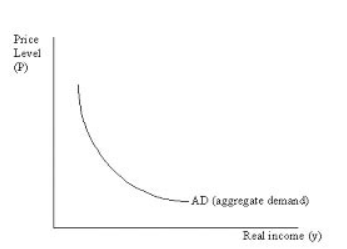

The Aggregate Demand (AD) Curve

The aggregate demand curve shows the total quantity of goods and services demanded in the economy at different price levels, holding all other factors constant. The relationship between the price level and aggregate demand is negative, meaning that as the price level rises, the total quantity of goods and services demanded falls, and vice versa. This inverse relationship is explained by three main effects:

1. The Wealth Effect

When the price level rises, the real value of wealth (such as savings) falls. This causes consumers to feel poorer, leading to a reduction in consumption and, therefore, a fall in AD.

2. The Interest Rate Effect

As the price level rises, people demand more money to carry out transactions. This leads to an increase in interest rates, which discourages investment and consumption. Higher interest rates reduce borrowing and spending, leading to a decrease in AD.

3. The Exchange Rate Effect

When the price level rises, domestic goods become more expensive relative to foreign goods. This can lead to a reduction in exports and an increase in imports, resulting in a fall in net exports (X - M) and a decrease in AD.

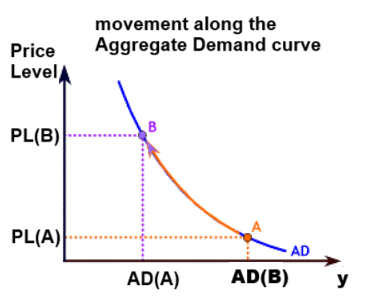

The Distinction Between a Movement Along, and a Shift of, the AD Curve

It is crucial to distinguish between a movement along the AD curve and a shift of the AD curve, as they represent different types of changes in the economy.

Movement Along the Aggregate Demand Curve

A movement along the Aggregate Demand curve occurs when there is a change in the price level, which leads to a change in the quantity of goods and services demanded, but other factors affecting AD remain constant (i.e., consumption, investment, government spending, and net exports do not change). For example:

- If the price level rises, a movement up the AD curve occurs, leading to a decrease in AD due to the wealth, interest rate, and exchange rate effects.

- If the price level falls, a movement down the AD curve occurs, leading to an increase in AD.

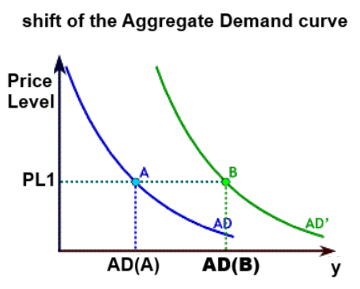

Shift of the Aggregate Demand Curve

A shift of the Aggregate Demand curve occurs when one of the components of AD changes, independently of the price level. For example:

- An increase in consumption (due to higher incomes or lower interest rates) would shift the AD curve to the right, as more goods and services are demanded at every price level.

- An increase in government spending (e.g., through a fiscal stimulus) would also shift the AD curve to the right.

- A decrease in investment or a reduction in exports would shift the AD curve to the left, as less is demanded at each price level.

Factors that can shift the AD curve include:

- Changes in consumer confidence or business confidence.

- Changes in fiscal policy (e.g., increased government spending or tax cuts).

- Changes in monetary policy (e.g., interest rate changes).

- Changes in foreign demand for exports.

Summary of Key Points

- Aggregate Demand (AD) is the total demand for goods and services in the economy and consists of consumption (C), investment (I), government spending (G), and net exports (X - M).

- The relative importance of each component varies, but consumption is usually the largest contributor to AD in most economies.

- The AD curve slopes downward because of the wealth, interest rate, and exchange rate effects.

- A movement along the AD curve is caused by a change in the price level, while a shift of the AD curve is caused by changes in any of the components of AD.

By understanding the factors that influence AD and how the AD curve behaves, you can better analyse changes in the UK economy, such as economic growth, inflation, and policy responses.