Conflicts Between Objectives & Policies

This section explains conflicts and trade-offs between objectives and policies, including potential conflicts and trade-offs between the macroeconomic objectives. In economics, macroeconomic objectives refer to the key goals that policymakers aim to achieve to ensure a stable and prosperous economy. These objectives typically include economic growth, low unemployment, low and stable inflation, balance of payments equilibrium, and income equality. However, achieving one objective can sometimes conflict with others, leading to trade-offs.

The policies used to achieve these objectives can also have unintended consequences, leading to conflicts between them. Understanding these trade-offs and conflicts is essential for analysing economic policy and its potential effects.

Potential Conflicts and Trade-Offs Between the Macroeconomic Objectives

Economic Growth vs. Inflation:

Conflict: Achieving high economic growth can lead to inflation. As the economy grows, demand for goods and services increases. If this demand exceeds supply, it can lead to demand-pull inflation, where prices rise as businesses struggle to meet higher demand.

- Example: During periods of strong economic expansion, such as the economic boom, the risk of inflation rises, which may require the central bank to implement measures to reduce inflation, potentially slowing down economic growth.

Economic Growth vs. Unemployment:

Conflict: While economic growth tends to reduce unemployment over time, in the short run, economic growth can lead to inflationary pressures that may require the government or central bank to implement policies that slow down growth and increase unemployment.

- Example: In the Global Financial Crisis of 2008, efforts to stimulate growth led to job creation in some sectors, but in the long run, economic adjustments to address high public debt led to higher unemployment rates.

Low Inflation vs. High Employment:

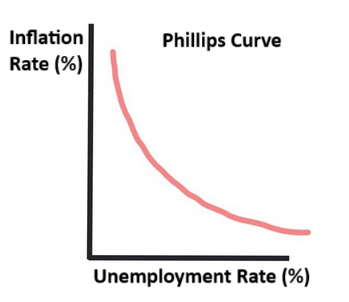

Conflict: The Phillips Curve suggests that there is an inverse relationship between inflation and unemployment in the short run. Reducing inflation often results in higher unemployment, and vice versa.

- Example: A government might attempt to reduce inflation by tightening monetary policy (raising interest rates), which could reduce inflation but potentially lead to a rise in unemployment.

Balance of Payments (BoP) Equilibrium vs. Economic Growth:

Conflict: Policies aimed at achieving a BoP equilibrium (such as reducing imports or increasing exports) may involve reducing domestic demand or implementing protectionist policies. However, these measures can stifle economic growth by limiting the flow of goods, services, and capital into the economy.

- Example: Efforts to reduce a current account deficit by imposing tariffs on imports might reduce economic growth, as imports contribute to consumption and investment.

Income Equality vs. Economic Growth:

Conflict: Policies designed to reduce income inequality (e.g., higher taxes on the rich, increased welfare spending) might reduce the incentives for entrepreneurship and investment, potentially slowing down economic growth. On the other hand, rapid economic growth can lead to increased inequality if the benefits are unevenly distributed.

- Example: A progressive tax system can help reduce inequality but might also reduce the incentives for high earners to invest, which could slow down overall economic growth.

The Short-Run Phillips Curve

The Phillips Curve illustrates the trade-off between inflation and unemployment in the short run. It suggests that, in the short term, there is an inverse relationship between the two, that is, lower unemployment leads to higher inflation and higher unemployment leads to lower inflation.

- Low Unemployment, High Inflation: When unemployment is low, demand for goods and services is high, which can lead to inflationary pressures as firms increase prices to meet the demand.

- High Unemployment, Low Inflation: When unemployment is high, demand in the economy is lower, and businesses are less likely to raise prices, resulting in lower inflation.

Shift of the Phillips Curve:

- The Phillips Curve can shift due to supply shocks or changes in expectations. For example, an increase in oil prices (a supply shock) can lead to higher inflation without reducing unemployment, shifting the Phillips Curve upwards. Similarly, if inflation expectations rise, the curve may shift to the right, meaning that for any given level of unemployment, inflation will be higher.

Potential Policy Conflicts and Trade-Offs

Economic policymakers use a range of tools to achieve macroeconomic objectives, including fiscal policy (government spending and taxation) and monetary policy (control of the money supply and interest rates). However, these policies can often conflict, especially when they are aimed at achieving different objectives.

Fiscal vs. Monetary Policy Conflicts:

Fiscal Policy: Government spending and taxation can be used to stimulate the economy. However, high government spending can lead to higher budget deficits and debt, which may cause future economic instability. To control debt, a government might raise taxes or reduce spending, which could conflict with policies aimed at stimulating economic growth.

Monetary Policy: The central bank can adjust interest rates to control inflation or stimulate demand. Lower interest rates can boost economic growth but may increase inflation, while raising interest rates can reduce inflation but may slow economic growth.

- Example: If the government is trying to boost demand through fiscal stimulus (higher public spending), the central bank might raise interest rates to control inflation, which could undermine the government’s stimulus efforts.

Supply-Side Policies vs. Demand-Side Policies:

- Demand-Side Policies (such as reducing interest rates or increasing government spending) aim to boost aggregate demand (AD), whereas supply-side policies (such as tax cuts for businesses, deregulation, and investment in infrastructure) aim to improve the economy’s productive capacity.

- Potential Conflict: Demand-side policies can lead to inflation, while supply-side policies take time to show their effect on economic output. If demand is stimulated too quickly, it could create inflationary pressures that undermine the long-term benefits of supply-side improvements.

- Example: A government might increase spending on infrastructure (a supply-side policy) while also cutting taxes to boost demand. However, if demand increases too quickly, it could result in inflation, which would harm long-term growth.

Inflation Targeting vs. Unemployment:

- Central banks often use interest rates to control inflation. However, raising interest rates can increase the cost of borrowing, which could reduce consumer spending and investment, leading to higher unemployment.

- Trade-Off: There is a trade-off between inflation targeting and unemployment. Lowering interest rates can stimulate economic activity and reduce unemployment, but it might increase inflation. Conversely, increasing interest rates to reduce inflation can lead to higher unemployment in the short term.

Structural Reforms vs. Short-Term Costs:

- Supply-Side Policies (such as labour market reforms, deregulation, and improved education) may require structural changes that take time to implement and bear fruit.

- Trade-Off: These policies may lead to short-term costs, such as higher unemployment during the transition or temporary disruptions to markets, even though they might improve long-term growth prospects.

Summary

The achievement of macroeconomic objectives is often characterised by conflicts and trade-offs. For instance, the desire for low inflation might conflict with the goal of high employment, and economic growth may lead to higher inflation. Fiscal and monetary policies can conflict, especially when they are aimed at achieving different objectives. The Phillips Curve illustrates the short-run trade-off between inflation and unemployment. Policymakers must weigh the benefits and costs of different policies, recognising that achieving one objective may come at the expense of another, especially in the short run. By understanding these trade-offs and conflicts, economists and policymakers can better navigate the complex landscape of macroeconomic decision-making.